2025 trends - GTM will be the BIGGEST worry for Founders and yet...

Go-To-Market (GTM) Challenges and Opportunities for 2025

Here are few insights from various end-of the reports I read this weekend

TL;DR

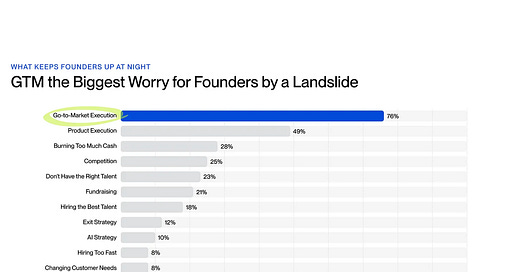

GTM is the Biggest Worry for Founders

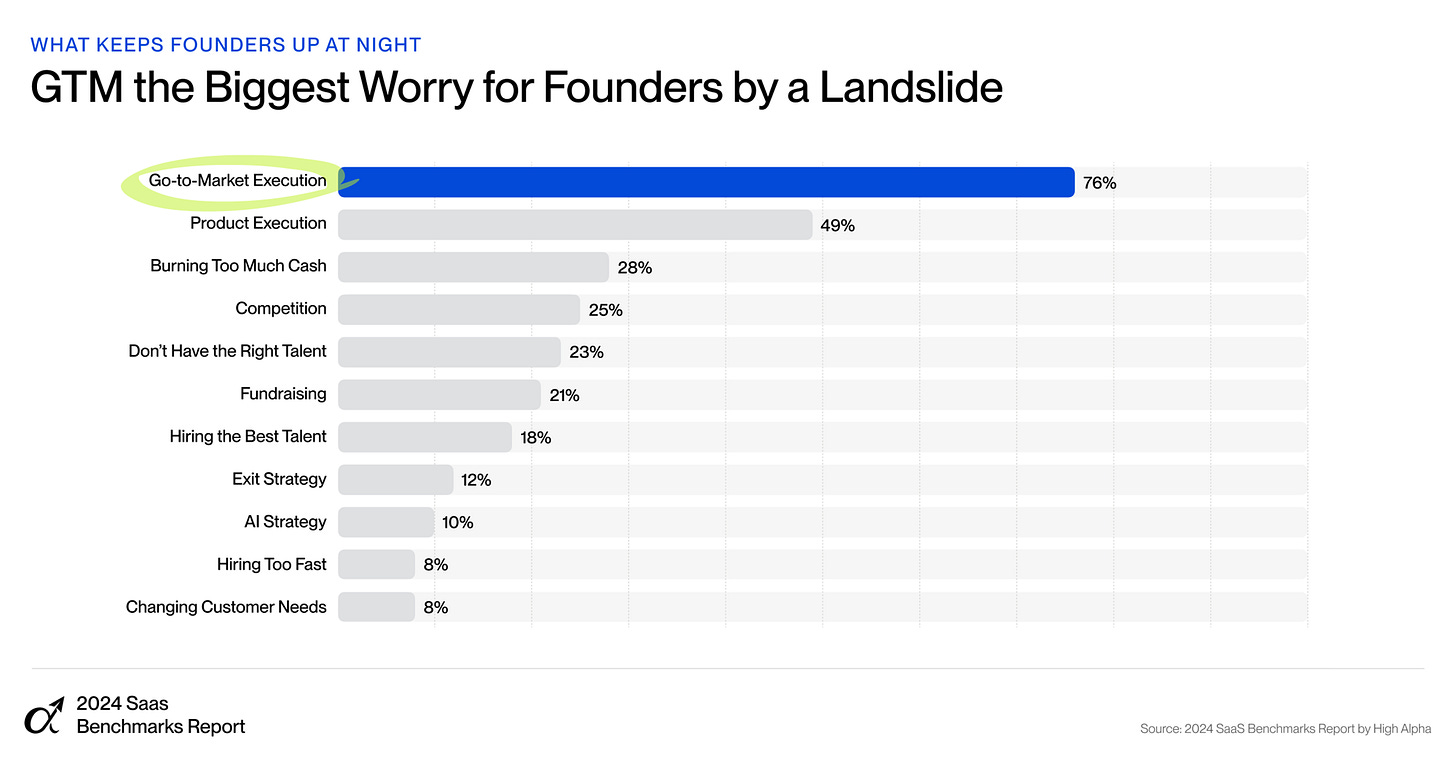

Customer Acquisition Costs are increasing rapidly

Founders are planning for a HIGHER Next Year Growth Rate vs. the Current Growth Rate

Buyers need to determine GTM motions

Outbound is creating more SPAM and they won't stop

Vertical AI SaaS Companies are growing faster with PLG

1. GTM is the Biggest Worry for Founders

Source: High Alpha - 2024 SaaS Benchmarks Report - by High Alpha

Thank you Kristian Andersen

B2B Industry Stats

Source: https://www.glencoco.com/state-of-outbound-sales-2024

54% noted customer acquisition costs increased in the last 12 months

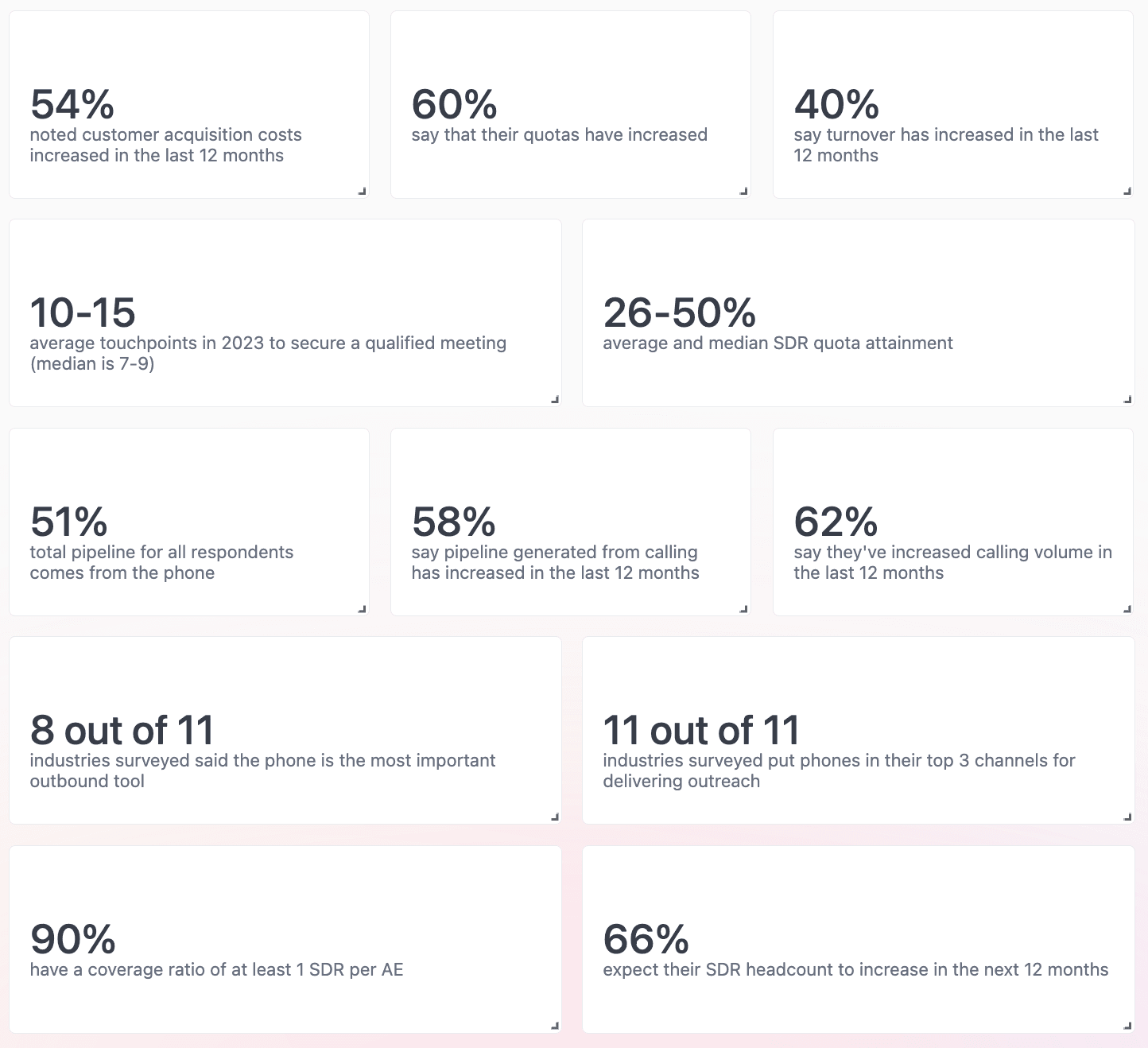

2. Customer Acquisition Costs (CAC) is increasing…pretty rapidly

Source: Benchmarkit - Blended CAC Ratio. Thank you Ray Rike

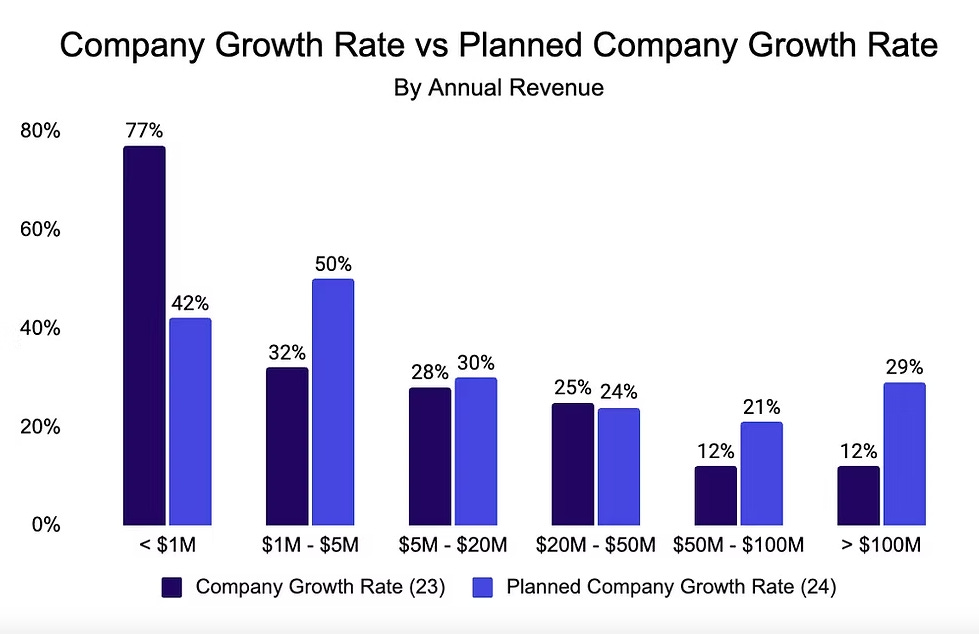

3. Founders are planning for a HIGHER Next Year Growth Rate vs. The Current Growth Rate

Source: Benchmarkit > Company Growth Rate

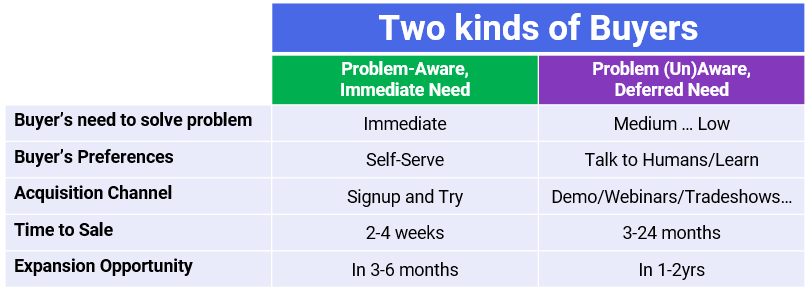

4. Buyers need to determine GTM motions

The type of GTM motion depends on the type of Buyer. And there seem to be 2 distinct ones

Problem Aware and Immediate Needs --> Prefers a self-serve discovery of value. Signup, Try and Buy is a huge preference.

Problem (Un)Aware Or Deferred Need --> Prefers to learn by talking and interacting with humans.

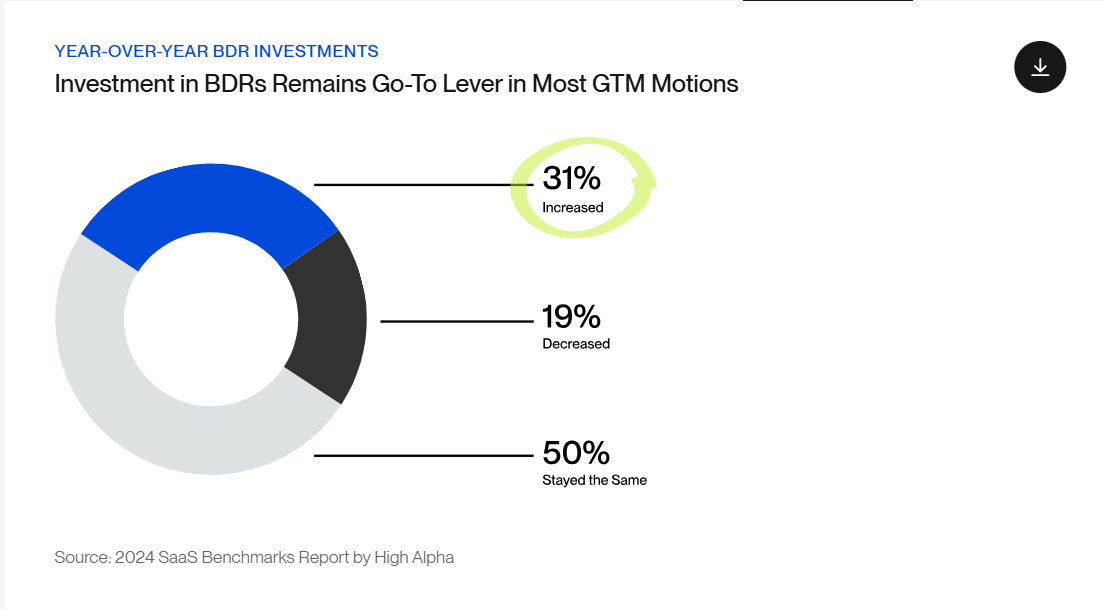

5. Outbound is creating more SPAM and they won't stop

More SDRs are getting hired

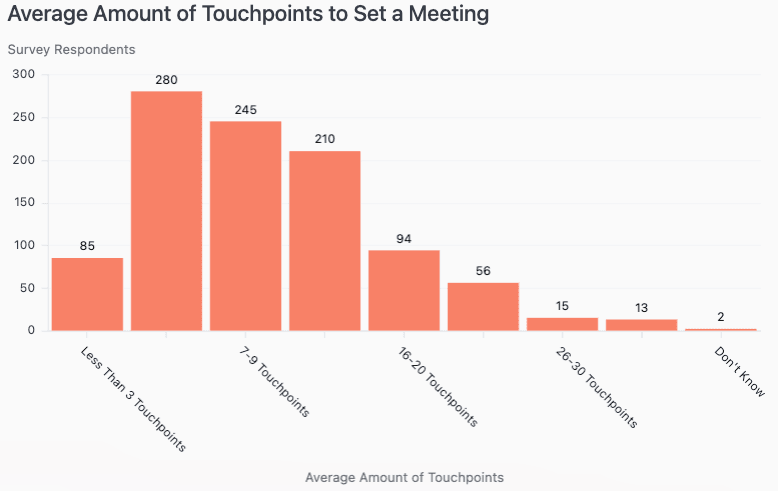

It takes more tries to get to a meeting.

It takes seven or more touchpoints to land a meeting with prospects. Broken out by job title, VPs and Directors of Sales said it actually takes 10-15.

This MORE TRIES approach is creating 4x SPAM in general.

Buyer's mailboxes and LinkedIn messages are getting bombarded - leading to a Great Ignore - Mark Kosoglow 's favorite subject

6. Vertical AI SaaS Companies are growing faster with PLG

More and more AI SaaS companies are deploying Product-Led Self-Serve Motions faster than others.

The combination is causing Growth rates of these companies to surge.

Any other recommendations for year-end reading?